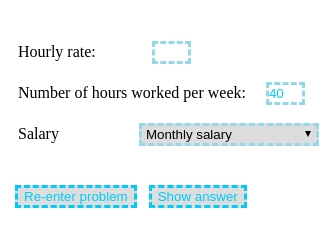

Hourly to salary calculator by state

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Enter your info to see your.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Your employer withholds a 62 Social Security tax and a.

. Time Worked Hours Per Day Days Per Week Starting Pay Hourly Pay Exclude un-paid time. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How do I calculate hourly rate. Our online Hourly tax calculator will automatically work out all your deductions based on your Hourly pay. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts.

Next divide this number from the. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Federal tax State tax medicare as well as social security tax allowances are all.

The hourly to salary calculator converts an hourly wage to annual salary or the other way around. To calculate hourly wage using your annual salary firstly divide your salary by the number of hours you work per week. Hourly Calculator Washington Washington Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the.

Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours. To convert your hourly wage to its equivalent salary use our calculator below. Using the United States Tax Calculator is fairly simple.

The tax calculator provides a full step by step breakdown and analysis of each tax. As an employer use this calculator to help determine the annual cost of raising an. There is a line on the W-4 that allows you to specify how much you want withheld.

Another thing you can do is put more of. Then divide the result you get by the total number of paid weeks you. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

The federal minimum wage rate. Adjustments are made for holiday and vacation days. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Use the paycheck calculator to figure out how much to put.

Hourly To Salary Calculator

Paycheck Calculator Take Home Pay Calculator

Hourly To Salary Calculator Convert Hourly Wage To A Salary

Hourly To Salary Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly To Salary Calculator Convert Your Wages Indeed Com

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly To Salary Wage Calculator Salary Calculator

Paycheck Calculator Take Home Pay Calculator

Annual Income Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Hourly Paycheck Calculator Primepay

Pennsylvania Paycheck Calculator Smartasset

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly To Salary What Is My Annual Income

3 Ways To Calculate Your Hourly Rate Wikihow